Media and Internet Concentration in Canada, 1984-2013

This is the second post in a series. Building on last week’s post that analyzed the growth of the media economy between 1984 and 2013, this post addresses the same timeframe and another deceptively simple yet profoundly important question:

have telecom, media and internet (TMI) markets become more or less concentrated over time and how do we know one way or another?

Creating an accurate and coherent portrait of media concentration is difficult. As Eli Noam (2009; also see 2013) notes in Media Ownership and Concentration in America, this is because good data is hard to come by and because the issue is highly politicized.

Similar problems exist in Canada. As Philip Savage notes, debates over media concentration in this country “largely occur in a vacuum, lacking evidence to ground arguments or potential policy creation either way”. The public policy record groans under the weight of “expert reports” bought and paid for by industry interests, far eclipsing independent scholarly research and public interest voices.

This post wades into the field by providing a long-term, systematic and data-driven analysis of concentration trends across a dozen or sectors of the media, internet and telecoms industries in Canada: wireline and wireless telecoms, internet access, broadcast distribution undertakings (cable, satellite & IPTV), specialty and pay TV, broadcast TV, radio, newspapers, magazines, search engines, social media, online news sources, browsers and smart phone operating systems. These are the essential elements of what I call the network media economy.

Concentration trends are assessed sector by sector, and then across the network media as a whole using two common analytical tools — concentration ratios (CR) and the Herfindahl – Hirschman Index (HHI) — to judge whether the markets are concentrated or competitive.

We cite our sources below but, by and large, our Media Industry Data and Methodology Primary underpin the analysis as a whole. The full post is in a downloadable PDF here.

Contentious Debates, Main Issues: Four Schools of Thought on Media Concentration

To some, the idea of studying the media concentration in an age of the internet and information abundance is misguided. With a gazillion websites, social networking sites galore, a roiling blogosphere, pro-am journalists, six hundred and fifty or so TV channels licensed for delivery in Canada, one hundred and four daily newspapers[1] and smartphones in every pocket, what is the problem?

If there was ever a golden media age, this is it, argue Thierer & Eskelen, 2008. MIT media economics professor, Ben Compaine (2005) offers a terse one-word retort to anyone who thinks otherwise: Internet.

This is a view congenial to Canada’s largest telecom and media companies and it is one that they and their experts often rely on. Thus, as BCE said during the second round of Astral Media hearings at the CRTC, while critics allege that media concentration in Canada is high, the evidence, “regardless of the metric employed – proves otherwise” (Bell Reply, para 46). Telecom, media and internet markets are “fiercely competitive”, industry insiders say.

Furthermore, any attempt to shackle media companies with ownership restrictions is doomed to condemn them to a slow death as they face global media giants such as Google, Amazon, Netflix, Facebook, and so on (Skorup & Thierer, 2012; Dornan, 2012). Powerful economies of scale are the heart of the digital media industries, and given this reality, bigger really is better, or so the argument goes.

Critics, in contrast, tend to see the problem of media concentration as going from bad to worse. Ben Bagdikian’s argues that the number of media firms in the US that account for the majority of revenues plunged from 50 in 1984 to just five by the mid-2000s. Canadian critics also decry what they see as similar trends, and the debasement of news and the political climate of the country generally that has ensued as a result (here and here).

Critics such as John Foster & Robert McChesney (2011) also argue that while the digital revolution is radically changing the world, key elements of the internet are no more immune to concentration than traditional media. Moreover, the internet is delivering mortal blows to journalism by draining dollars away from newspaper advertising and fragmenting audiences. Consequently, the number of daily newspapers and full-time journalists in the United States, Canada and Europe are in free fall, argue the critics, while the ranks of under-employed journalists are turning to public relations in droves, promoting special interests rather than the public interest as a result (McChesney, 2014).

A third school aims to detect the influence of changes of media ownership and consolidation by quantitatively analyzing reams of media content. They generally find that the evidence is “mixed and inconclusive” (here). A recent study in this vein, Cross-Media Ownership and Democratic Practice in Canada: Content-Sharing and the Impact of New Media, reaches similar conclusions (Soderlund, Brin, Miljan & Hildebrandt, 2011).

Such findings, however, proceed as if ‘impact on content’ is the only concern, or as Todd Gitlin put in many years ago, as if ‘no effect’ might not be better interpreted as preserving the status quo and thus a significant problem in its own right. To my mind, reducing the range of questions at hand to a focus on content is akin to trying to draw the proverbial camel through the eye of a needle.

A fourth school of thought, and one that I largely subscribe to, agrees that the shift from the industrial media of the 19th and 20th centuries to the digital, internet-centric media ecology of the 21st century does entail enormous changes. However, this approach argues that these changes entail an equally enormous “battle over the institutional ecology of the digital environment” (Benkler, 2006, ch. 11). Indeed, the history of human communication is one of recurring ‘monopolies of knowledge” (Innis, 1951) and oscillations between consolidation and competition (John, 2010; Babe, 1990), so why should we expect this to be any less true today (Noam, 2009; Benkler, 2006; Wu, 2010; Crawford, 2012)?

The approach has some similarities with the critical school in its insistence that core elements of the digital media ecology and internet are no less prone to concentration than previous media. However, it breaks ranks on the grounds that while concentration is possible, it is not inevitable, and there are cross-cutting trends across media, over time and between countries. Moreover, outcomes on each of these dimensions turns on the specific configuration of technology, markets and politics that prevails in any given time and place. There is also more attention to empirical evidence and the details of specific media companies and markets in the fourth school of thought relative to the work of most critical approaches.

From this perspective, the core elements of the networked digital media – wireless (Rogers, BCE, Telus), search engines (Google, Bing, Yahoo, DuckDuckGo), Internet access (ISPs), music and book retailing (Apple and Amazon), social media (Facebook) and access devices (Apple, Google, Samsung) – may actually be more prone to concentration because digitization magnifies economies of scale and network effects in some areas, while reducing barriers to entry in others, thereby allowing many small players to flourish. A two-tiered digital media system may be emerging, with numerous small niche players revolving around a few enormous “integrator firms” at the centre (Noam, 2009; Wu, 2010).

Reflecting on the results of a thirty-country study, Noam (2013) finds that media concentration levels around the world are “astonishingly high”. Some insight into whether Canada ranks high, low or in between by international standards can be seen in Noam’s study, and in some of the discussion that follows, especially around the issue of vertical integration.

For the time being, however, it is time to put the oft-claimed assertion that Canada has the highest levels of telecoms and media concentration in the world, G7, OECD countries, etc. to rest. It does not. Although on the specific measure of vertical integration, it does, and overall there is little cause for complacency, as shown below. In sum, the evidence is sufficient enough to raise serious concerns about the current state of affairs and the ongoing drift of events without having to be alarmist about either.

Why Does Media Concentration Matter, or Who Cares?

All these considerations matter because the more core elements of the networked media are concentrated, the easier it is for dominant players to exercise market power, coordinate behaviour, preserve their entrenched stakes in ‘legacy’ media sectors (e.g. television and film), lock up and leverage premium content to sell subscriptions to their more lucrative mobile phone, internet and cable services, stifle innovation, influence prices, work against market forces and subordinate the interests of consumers, citizens and the economy and society to their own interests generally (see here, here, here, here, here and here).

Large consolidated telecom, media and internet giants also make juicy targets for those who would turn them into proxies working on behalf of the copyright industries, efforts to block pornography, and as part of the machinery of law enforcement and national security (see here, here, here and here). In sum, the more concentrated digital media giants are, the greater their power to:

- set the terms for the distribution of income to musicians, journalists and media workers, and authors (Google, Apple, Amazon);

- turn market power into gatekeeping power and moral authority by regulating which content and apps providers, for instance, gain access to their operating systems, online retail spaces and what content can be distributed via their ‘walled gardens’ and which cannot, as Apple’s decision to restrict ‘adult content’ availability on iTunes and its removal of a fund-raising app for Wikileaks on the AppStore illustrate, for example;

- set the terms for owning, controlling, syndicating and selling advertising around user created content (Google, Facebook, Twitter) (van Couvering, 2011; Fuchs, 2011);

- use media outlets they own in one area to promote their interests in another (see Telus intervention in Bell Astral, 2.0 pages 4-6 and here);

- set defacto corporate policy norms governing the collection, retention and disclosure of personal information to commercial and government third parties.

Whilst we must adjust our analysis to new realities, long-standing concerns also remain alive and well. Consider, for example, the fact that in the last federal election every newspaper in Canada, except the Toronto Star, that editorially endorsed a candidate for Prime Minister touted Harper – three times his standing in opinion polls at the time and the results of the prior election.

Ultimately, talk about media concentration is a proxy for larger conversations about consumer choice, freedom of the press, citizens’ communication rights and democracy. Such discussions must adapt to changes in the techno-economic environment of the media, of course, but the advent of digital media does not render them irrelevant (Baker, 2007; Noam, 2009; Peters, 1999).

Methodology: How Do We Know One Way or Another Whether Media Concentration Exists?

Measuring media concentration begins by defining the media industries to be studied, as done at the outset of this post. Revenue data for each of these sectors, and for each of the firms within them with over a one percent market share, is then collected and analyzed. This handy dandy list of sources and others listed here were used.

Each media sector is analyzed on its own and then grouped into three categories, before scaffolding upwards to get a birds-eye view of the entire network media ecology: (1) platform media; (2) content media: (3) online media. The results are analyzed over time from 1984 to 2013. Lastly, two common tools — Concentration Ratios (CR) and the Herfindhahl – Hirschman Index (HHI) – are used to depict concentration levels and trends over time within each sector and across the network media ecology as a whole.

The CR method adds the shares of each firm in a market and makes judgments based on widely accepted standards, with four firms (CR4) having more than 50 percent market share and 8 firms (CR8) more than 75 percent considered to be indicators of media concentration (see Albarran, p. 48). The Competition Bureau uses a more relaxed standard, with a CR4 of 65% or more possibly leading to a deal being reviewed to see if it “would likely . . . lessen competition substantially” (p. 19, fn 31).

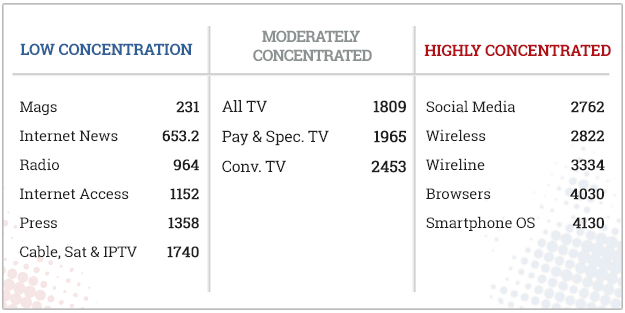

The HHI method squares and sums the market share of each firm in a market to arrive at a total. If there are 100 firms, each with 1% market share, then markets are thought to be highly competitive, whereas a monopoly prevails when one firm has 100% market share. The US Department of Justice set out new HHI guidelines in 2010 for determining when concentration is likely to exist, with the new thresholds set as follow:

HHI < 1500 Unconcentrated

HHI > 1500 but < 2,500 Moderately Concentrated

HHI > 2,500 Highly Concentrated

At first blush, these higher thresholds seem to dilute the standards that had been set at lower levels and used since 1992. While this is probably true, the new guidelines are probably even more sensitive to reality and tougher than the ones they supersede.

This is because they go beyond setting thresholds to give more emphasis to the degree of change in market power when proposed ownership changes take place. For instance, “mergers resulting in highly concentrated markets that involve an increase in the HHI of more than 200 points will be presumed to be likely to enhance market power”, observes the DOJ (emphasis added, p. 19).

Second, markets are defined more precisely based on geography and the relevant details of the good at hand versus loose amalgamations of things based only on superficially similarities. This is critical, and it distinguishes those who would define the media universe so broadly as to put photocopiers and chip makers alongside ISPs, newspapers, film and TV and call the whole thing “the media” (e.g. Skorup & Theirer; Compaine) versus the scaffolding approach we use and that starts by analyzing each sector before moving up to higher levels of generality from there until reaching a birds-eye perspective on the network media as a whole.

Third, the new guidelines turn a circumspect eye on claims that enhanced market power will be good for consumers and citizens because they will benefit from the increased efficiencies that result. What is good for companies is not necessarily good for the country (see Stucke & Grunes, 2012).

Lastly, the new guidelines are emphatic that decisions turn on “what will likely happen . . . and that certainty about anticompetitive effect is seldom possible and not required for a merger to be illegal” (p. 1). In practice this means the goal is to nip potential problems in the bud before they occur. This means that experience, the best available evidence, contemporary and historical analogies as well as reasonable economic theories are the basis of judgment, not deference to impossible (and implacable) demands for infallible proof (p. 1).

These assumptions overturn more than a quarter-century of Chicago School economic orthodoxy and its grip on thinking about market concentration (see Stucke & Grunes, 2012 and Posner). Freed from Chicago School orthodoxy, and the subordination of policies and politics to conservative economists, think tanks and judges, the new guidelines set a tough hurdle for those with the urge to merge. It was such thinking that killed the bid by AT&T – the second largest mobile wireless company in the US – to acquire T-Mobile, the fourth largest, in 2011, for instance (also Stucke & Grunes, 2012).

In Canada, in contrast, the CRTC Diversity of Voices sets up thresholds for a broadly defined TV market in which a proposed deal that results in a single owner having less than 35% of the total TV market will be given the green light; those that fall in the 35-45% range might be reviewed; anything over 45% will be rejected (para 87). Unlike the Competition Bureau that uses the CR4 method whereby a deal that result in a CR4 over 65% may be reviewed to determine whether it will substantially lessen competition, the CRTC has no such guidelines, although last year’s accord between the two regulators might change this.

The CRTC’s threshold for TV, instead, is based on a single snapshot of a single company’s share of one broadly defined market – the total TV market –“before” and “after” a single transaction. It is a static measure that has no sense of trends over time, the relational structure of markets, or any capacity to analyze the drift of events across media and the network media ecology as a whole.

The Competition Bureau draws selectively from the US HHI guidelines. It does not use the HHI thresholds. Instead, it focuses on “the relative change in concentration before and after a merger” (emphasis added, p. 19, fn 31). How faithful it is to either its CR4 guidelines or the HHI criteria for judging relative changes in market power is open to question, however, in light of its 2013 decision to bless Bell Canada Enterprises’ take-over of Astral Media, then the fifth largest television company in the country and biggest non-vertically integrated company of its kind (here). In Canada regulators appear to make it up as they go along rather than consistently following a coherent set of guidelines in judging issues of market power.

The Historical Record and Renewed Interest in Media Concentration in the 21st Century

There has always been keen interest in media concentration in Canada and the world since the late-19th and early-20th centuries.

In 1910, for example, early concerns with vertical integration were registered when the Board of Railway Commissioners (BRC) – the distant cousin of today’s CRTC — broke up a three-way alliance between the two biggest telegraph companies — the Canadian Pacific Telegraph Co. and the Great Northwestern Telegraph Co. (the latter a branch of the New York-based goliath, Western Union) – and the American-based Associated Press news wire service. Why?

It did this, in the face of much corporate bluster, because allowing the telegraph companies to give away the AP news service for free to the leading newspaper in one city after another might be a good means for the companies to attract subscribers to their more lucrative telegraph business but it would effectively “put out of business every news-gathering agency that dared to enter the field of competition with them” (1910, p. 275). In a conscious bid to use telecoms (railway) regulation to foster competing news agencies and newspapers, Canada’s first regulator, the BRC, forced Western Union and CP Telegraphs to unbundle the AP news wire service from their telegraph service. It was a huge victory for the Winnipeg-based Western Associated Press – which initiated the case – and other ‘new entrants’ into the daily newspaper business (Babe, 1990).

Throughout the 20th century similar questions arose and were dealt with as the situation demanded. One guiding rule of thumb of communications policy, however, was that of the “separations principle”, whereby telecoms carriers – usually two of them, e.g. telegraph vs telcos in the early 1880s, the TransCanada Telephone System (TCTS) and CNCP for three-quarters of the 20th century, the telcos vs cablecos ever since, and the telco consortium Stentor versus Rogers/Cantel in the early days of mobile wireless from 1985 until the mid-1990s — competed to carry messages from all types of users, and for all types of purposes – business, personal, governmental and broadcasting – but were prevented by law (and by the lessons of their own history of mixed success in such ventures) from directly creating, owning or controlling the messages that flowed through their channels (or airwaves).

A general concern also hung in the air in government, business, broadcasting and reformist circles that those who made communications equipment, or operated transmission networks, should not normally operate broadcast stations, make movies or publish newspapers, books, etc. That this was so could be seen, for example, when the original equipment manufacturing consortia behind the British Broadcasting Company in the UK and the National Broadcasting Company / Radio Corporation of America in the US, respectively, in the 1920s were ousted during the remake of these entities into the stand-alone broadcasters they eventually became. Nor should telephone companies such as AT&T become involved in the nation’s film industry, as had become the case in the 1920s and 1930s after it had wired movie theatres across the United States and the Hollywood studios for sound, circa 1927ff (see Briggs, 1995; Barnouw, 1966; Danelian, 1939).

The consolidation of broadcasting under the CBC in the 1930s brought private broadcasters into the core of the Canadian ‘broadcasting system’ from the get-go. The creation of the CBC also wiped out important voices, foreign, local, educational and even theatrical radio clubs. In each case, it was the structure and organization of the communication / media system, and who owned what and in what proportions, that was a key issue.

The separation of transmission and carriage from message creation and control was another key principle that was worked out in a myriad of different ways. Aside from keeping the telegraph companies out of the news business, and telephone companies out of radio, most of the time such issues were considered tedious, boring, and tucked away in parliamentary papers, legislation and corporate charters. Bell’s charter, for instance, prohibited it from entering into many ‘content and information publishing services’, from radio to cable TV and ‘electronic publishing’, until the early 1980s, when they were whittled away until nothing was left of such prohibitions a decade-and-a-half later. The enabling documents of other telcos, private and public, across the country did the same, even though Manitoba and Saskatchewan were laying fibre rings and offering modest TV services in the 1970s (Babe, 1990; Winseck, 1998).

While typically bureaucratic and arcane, media concentration issues have come to a head on occasion, and been very public as a result. This was the case in the 1970s and again at the beginning of the 1980s, when three inquiries were held: (1) the Special Senate Committee on Mass Media, The Uncertain Mirror (2 vols.)(Canada, 1970); (2) the Royal Commission on Corporate Concentration (1978); and (3) the Royal Commission on Newspapers (Canada, 1981). While they did not mount to much in the end, they did leave a valuable historical and public record.

Things lay dormant for more than two decades thereafter before springing to life again after a huge wave of consolidation in the late-1990s and at the turn-of-the-21st century thrust concerns with media concentration back into the spotlight. Three inquiries between 2003 and 2008 were held as a result: (1) the Standing Committee on Canadian Heritage, Our Cultural Sovereignty (2003); (2) the Standing Senate Committee on Transport and Communications, Final Report on the Canadian News Media (2006); (3) the CRTC’s Diversity of Voices report in 2008.

Things have not let up since. Indeed, a non-stop series of reviews currently underway (or recently concluded) at the CRTC will go a long way to shaping the emergent internet-centric media ecology for decades, including, for instance: (1) Bell’s take-over of Astral Media, (2) wholesale wireless and wireline telecoms markets (and here), (3) Mobile TV services and (4) whether vertically-integrated telecom-media giants such as Rogers, Bell, and Videotron can leverage their control of premium content to drive subscriptions to their wireless, cable and internet services, with a test case now before the regulator with respect to Rogers’ use of its internet streaming app, GamePlus feature, to offer additional NHL hockey coverage (e.g. exclusive interviews, camera angles, statistics, analysis, etc.) solely to its own subscribers but not to those of its rivals.

Competitive Openings and Two (three?) Waves of TMI Consolidation

All of this is taking place, as I noted in my last post, within an ever more internet-centric media economy that has grown immensely from $39.4 billion in 1984 to $74.8 billion last year (in inflation-adjusted “2013 real dollars”). In the early phase of this period, the decade between 1984 and 1996, new players emerged across the media landscape, this meant more diversity in all sectors, except for newspapers as well as cable and satellite video distribution, where concentration climbed greatly.

Conventional as well as pay and subscription television channels expanded during this time as well. In terms of ownership, incumbents and a few newcomers, such as Allarcom and Netstar, cultivated the field, with their share of the market growing steadily.

Broadcasters often seemed to be tacked onto companies whose interests lay in numerous other, unallied areas, such as real estate, as with the BC TV and radio group Okanagan Skeena, or Molson’s Brewery, one of the founders of Netstar early on in that entity’s history. Media conglomerates were not unknown (Maclean-Hunter was a good example), but they were not the norm; Bell was more of a diversified conglomerate, or a communications collusus, but it was not in the media business proper, and was prevented by its charter and by law from being so.

Concentration levels remained sky high in wired line telecoms, while new mobile wireless telecoms services were developed by two well-entrenched firms: Bell and Rogers. Telecoms competition moved slowly from the ends of the network into services and then deeper into the network infrastructure, as it had done in one country after another around the world, aided and abetted by active government intervention that sought to use interconnection and network unbundling rules, access to spectrum, spectrum set asides, wholesale pricing regulation, and market liberalization to spur on competition. Competition gained traction in the 1990s but the trend was short-lived, and thrown into reverse by the dot.com crash in late-2000.

In the 1980s and early-1990s, consolidation took place mostly among individual players in single media markets. Conrad Black’s take-over of Southam newspapers in 1996 symbolized the times. In broadcast television, amalgamation amongst local and regional ownership groups created the large companies that came to single-handedly own the national commercial television networks by the end of the 1990s: CTV, Global, TVA, CHUM, TQS.

While weighty in their own right, these amalgamations did not have a big impact across the media. The CBC remained prominent, but public television was being eclipsed by commercial television as the CBC’s share of all resources in the television ‘system’ slid from 44 percent in 1984 to less than half that amount today (19.3%).

Whereas gradual change defined the 1980s and early-1990s, things shifted abruptly by the mid-1990s and into the 21st century when three waves of consolidation swept across the TMI industries. A few highlights help to illustrate the trends:

Wave 1: 1994 to 2000: Rogers’ acquisition of Maclean-Hunter (1994), but peaking from 1998 to 2001: (1) BCE acquires CTV and the Globe & Mail ($2.3b); (2) Quebecor takes over Videotron, TVA and the Sun newspaper chain ($ 7.4b) (1997-2000); (3) Canwest buys Global TV ($800m) and Hollinger newspapers papers, including National Post ($3.2b).

Wave 2: 2006-2007: Bell Globe Media re-branded CTVglobemedia, as BCE exits media business. CTVglobemedia acquires CHUM assets (Much Music, City TV channels and A-Channel). CRTC requires CTVglobemedia to sell City TV stations – acquired by Rogers (2007). Astral Media’s buys Standard Broadcasting. Quebecor acquires Osprey Media (mid-size newspaper chain)(2006). Canwest, with Goldman Sachs, buys Alliance Atlantis (2007) (Showcase, National Geographic, HGTV, BBC Canada, etc) – and the biggest film distributor in Canada.

Wave 3: 2010 – Present: Canwest goes bankrupt (2009-2010), its newspapers acquired by Postmedia and TV assets by Shaw. BCE makes a comeback, buys CTV (2011) and bids for Astral Media in 2012, but fails to gain CRTC approval, before gaining the regulator’s blessing last year. Bell sells Teletoon (TELETOON Retro, TELETOON Retro, TELETOON / TELETOON and the Cartoon Network), Historia and Séries+ to Corus (Shaw), the Family Channel, Disney Jr. and Disney XD to DHX media, and MusiquePlus and MusiMax to V Media, as well as ten radio stations to Newcap (5), Pattison (3) and Corus (Shaw)(2) — as required by the Competition Bureau and CRTC as a condition of their approval of Bell’s take-over of Astral media in 2013.

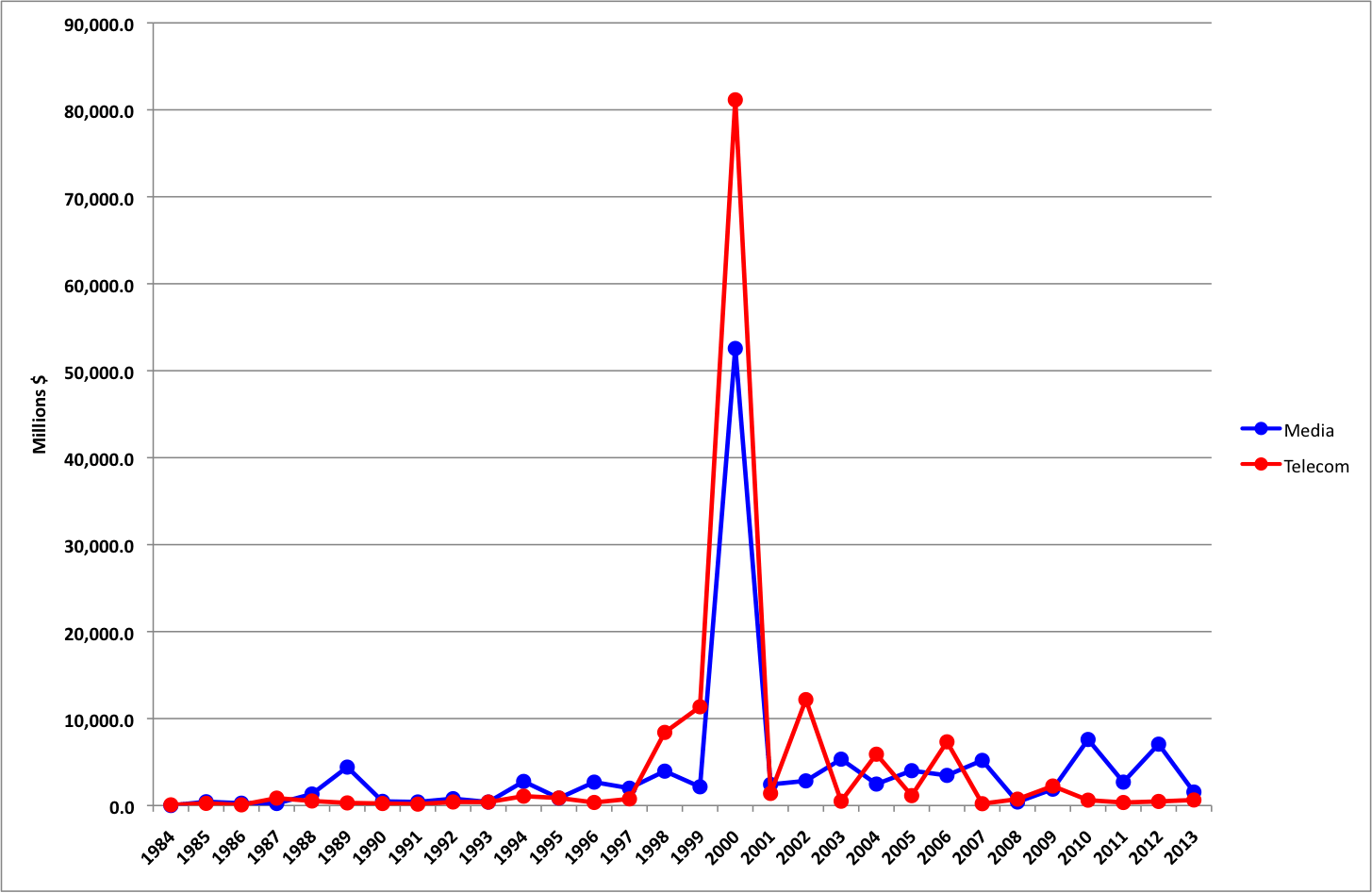

The massive influx of capital investment that drove these waves of consolidation across the telecom, media and Internet industries is illustrated in Figure 1 below.

Figure 1: Mergers and Acquisitions in Media and Telecoms, 1984–2013 (Mill$)

Sources: Thomson Reuters. Dataset on file with author.

Mergers and acquisitions rose sharply between 1994-1996, and spiked to unprecedented levels by 2000. The collapse of the telecom-media-technology, or dot.com, bubble put an end to such trends, until they regained steam again between 2004 and 2007 before once again grinding to a halt with the onset of the Global Financial Crisis (2007ff). Again, trends in the network media economy swiveled on those of the economy at large.

Consolidation on the telecoms side has fallen off in the past few years other than for Telus’s acquisition of Public Mobile in 2013. Acquisitions on the media side, as Figure 1 illustrates, however, have surged. Shaw’s take-over of Global TV in 2010, with its suite of thirty specialty and pay TV channels and nine television stations, from Canwest (2010) as well as Bell’s re-purchase of CTV (2011) and take-over of Astral last year, respectively — a set of acquisitions that transformed the country’s largest telecoms company into its biggest TV and radio broadcaster as well, with a suite of thirty conventional TV stations, thirty nine specialty and pay TV channels and 107 radio stations in fifty-five cities across the country — were largely responsible for the trend (see BCE, Annual Report, p. 29).

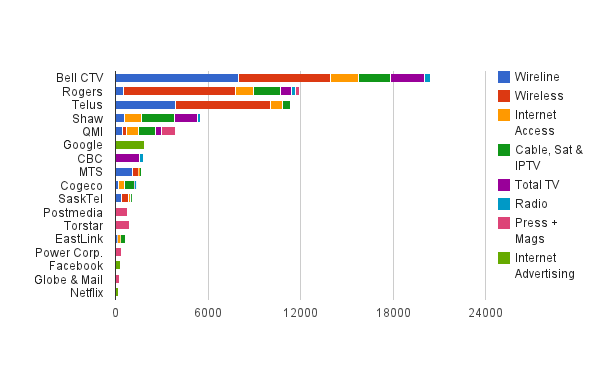

Consolidation in the TV industry is one of the main results. More importantly, however, consolidation has yielded a specific type of media company that now sits at the centre of the network media universe in Canada: i.e. the vertically integrated telecoms, media and internet conglomerate.

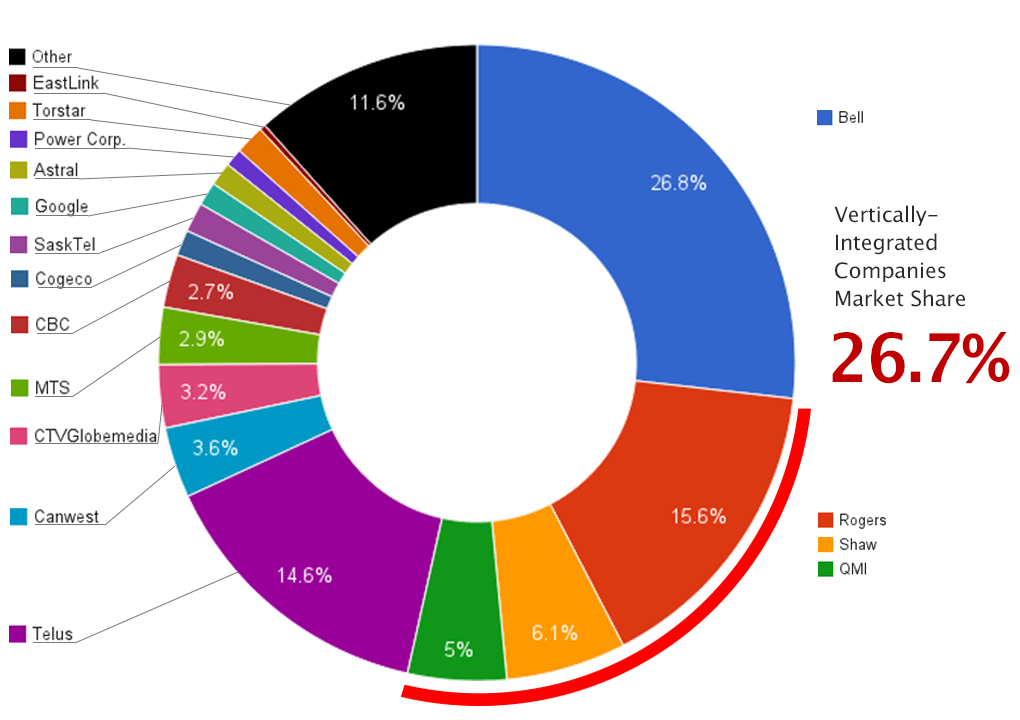

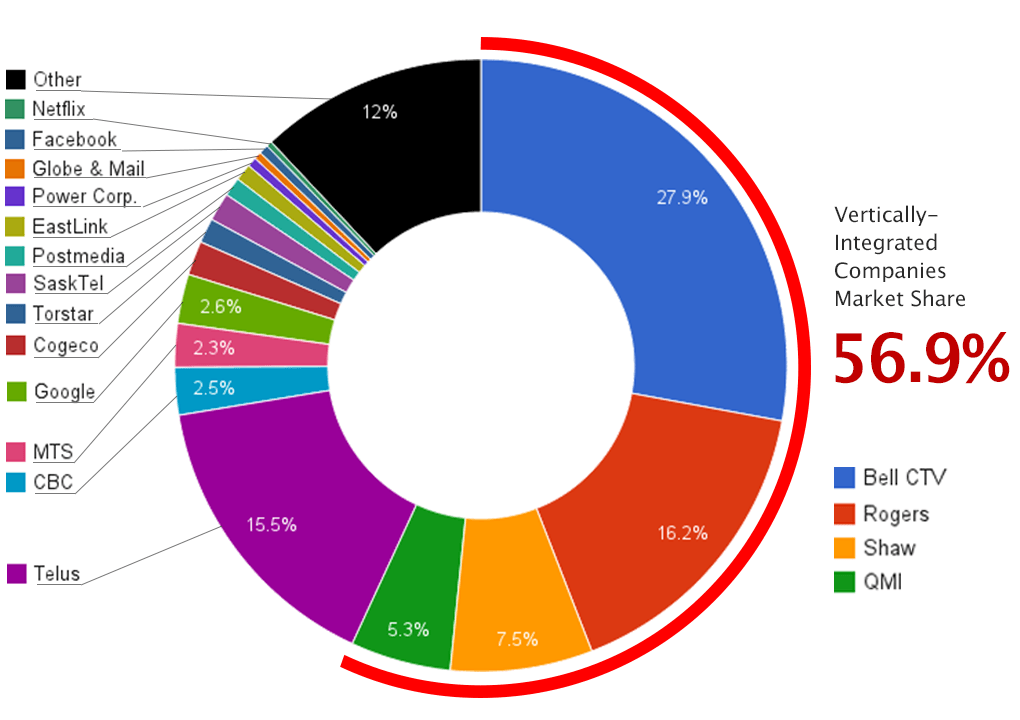

Figures 2 and 3, below, illustrate the enormous increase in vertical integration that took place between 2008 and 2013, as a result.

Figure 2: Vertical Integration and the Network Media Ecology, 2008

Sources: Media Industry Data (Vertical Integration & the Network Media Ecology)

Figure 3: Vertical Integration and the Network Media Ecology, 2013

Sources: Media Industry Data (Vertical Integration & the Network Media Ecology)

As Figures 2 and 3 illustrate, in the span of five years, the scale of vertical integration in Canada more than doubled. By 2013, four giant vertically integrated TMI conglomerates accounted for 57% of all revenue across the whole of the network media economy: Bell (CTV), Rogers (CityTV), Shaw (Global) and QMI (TVA), as Figure 3 shows. The latter figures also shows that, in terms of sheer size, other than Telus, the ‘big four’ vertically integrated media conglomerates – Bell, Rogers, Shaw and Quebecor – are in a league of their own.

This is important for several reasons. First, it distinguishes the past from the present. Centre stage is now occupied in Canada by less than a handful of vertically integrated telecoms, media and internet conglomerates with a reach across the network media ecology.

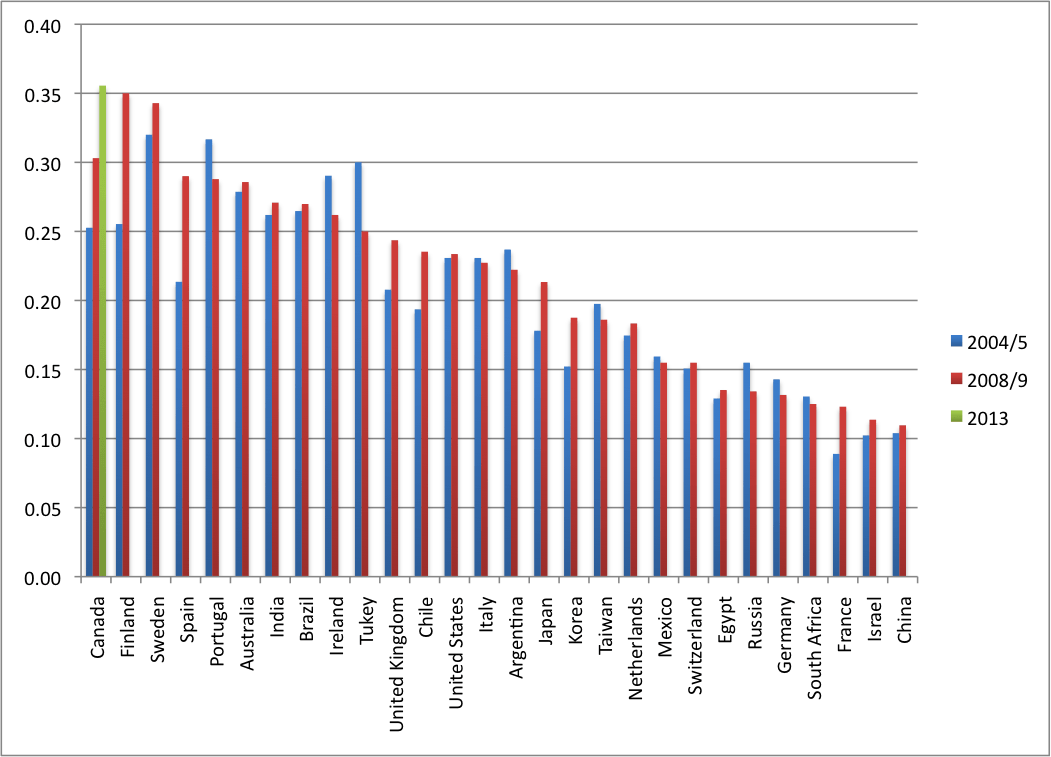

In addition to vertical integration being high by historical standards within Canada, it is very high by comparative international standards. Figure 4 below illustrates the point using the most recent data available for twenty-eight countries from the International Media Concentration Research Project (2009) and for Canada for the years covered by that project and 2013 after Bell’s acquisition of CTV and Astral Media.

Figure 4: Vertical Integration and Cross-Media Ownership — Canada in a Global Context, 2004 – 2013

Sources: Media Industry Data and International Media Concentration Research Project.

Figure 4 reveals several interesting points. For one, it shows that Canada has always been closer to the high end of the scale when it comes to vertical integration and cross media ownership than to the low end, ranking 19th out of 28 in 2004. By 2009, however, it had moved much closer to the top of the scale, with the third highest levels of vertical integration, after Finland and Sweden. In 2013, and after Shaw and BCE acquired Global TV, CTV and Astral Media, respectively, Canada had the highest levels of vertical integration and cross-media ownership out of the 28 countries studied.

While it is possible that similar processes took place in other countries after 2009, I am unaware of any of similar magnitude. Moreover, and in sharp contrast with the drift of events in Canada, in most countries, the trend over the time period examined was in the opposite direction.

Indeed, as scholars from across the political spectrum have chronicled, while popular within the industry and amongst the mergers and acquisition crowd in the late-1990s, the tide has turned since roughly, the mid-2000s, when media conglomerates have since collapsed or been dismantled ever since (e.g. AOL Time Warner, AT&T, Vivendi, Adelphia, CBS-Viacom, News Corp, etc). Of course, there are exceptions to the rule and in this case Comcast’s acquisition of NBCUniversal in 2011 in the United States exemplifies the point (Picard, 2011; Jin, 2013; Skorup & Thierer, 2012; Thierer & Eskelen, 2008; Waterman & Choi, 2010). Nonetheless, the main current in the media industries, as Dal Yong Jin observes, since the mid-2000s has been toward vertical dis-integration and de-convergence.

The following sections double back to look at things sector-by-sector, and within the three main categories that we use to group each of the sectors covered by the CMCR project:

- platform media (wireline & wireless, ISPs, cable, satellite, IPTV);

- ‘content’ (newspapers, tv, magazines, radio);

- ‘online media’ (search, social, operating systems).

At the end, I combine these again one last time to complete the analysis and gain a bird’s eye view of the network media industries as whole.

Platform Media

All sectors of the platform media industries are highly concentrated or at the high-end of the moderately concentrated scale. This has pretty much always been the case, although with important historical exceptions, and today, Internet Access continues to be a partial exception.

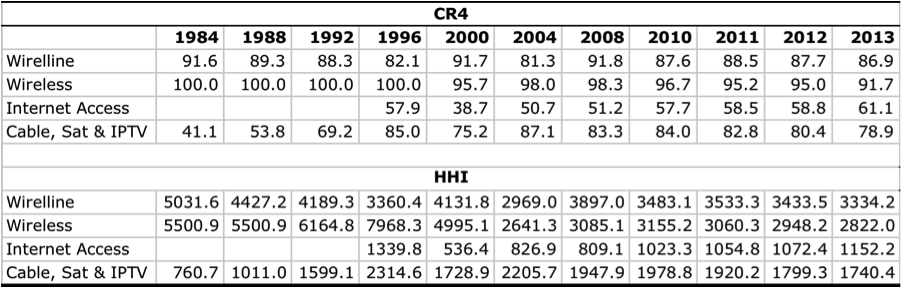

Table 1: CR and HHI Scores for the Network Infrastructure Industries, 1984 – 2013

Sources: Media Industry Data (CR & HHI Scores + Individual worksheets for each sector).

CR4 and HHI measures for wireline telecoms scores fell in the late-1990s as some competition took hold. Concentration in this sector reached its lowest levels ever between 2000 and 2004 before the dot.com bubble collapse wiped out many of the new rivals with it (CRTC, 2002, p. 21).

Competition waned thereafter until 2008, but has risen slightly since. Concentration remains very high nonetheless by both the CR4 and HHI measures, as Table 1 makes clear. Indeed, wireline telecoms is the most concentrated segment of the platform media industries, and one reason why the wholesale proceeding currently in play at the CRTC is so important. In many ways, whether indy ISPs gain access to such facilities, and the fibre-based networks that the telcos are now putting into place, will go a long way to determining their viability in the future.

Mobile Wireless

Wireless services have also consistently been highly concentrated, and still are, despite five new entrants joining the field since 2008: Wind, Videotron (Quebecor), Eastlink, Public and Mobilicity.

In 2013, Wind, Videotron, Public and Mobilicity combined accounted for just under 3% market share, but by year’s end Public had been acquired by Telus and, basically, closed, while Mobilicity struggled under bankruptcy protection. Add in MTS and SaskTel and the new entrants and other small regional carriers combined accounted for 8% of wireless revenues. Rogers, Bell and Telus accounted for the rest, or 92% of the market (see Wireless in Media Industry Data; CRTC, CMR, pp. 213-214).[2]

This is an increase over the previous year, when new entrants and the small regional carriers had about 5% market share by revenue. It is primarily due to the relatively rapid growth of Videotron in Quebec, and of Wind in a handful of key cities in Ontario, Alberta and BC. However, it is still far off the high-water mark of the late 1990s when two new competitors, Clearnet and Microcell, garnered 13% of the market between themselves. They were subsequently taken over by Telus and Rogers in 2000 and 2004, respectively.

Some recent studies argue “that there is not a competition problem in mobile wireless services in Canada” (see here, here and here).[3] However, that conclusion rests on assertions about efficiencies and contestible markets theory that do no hold up well under scrutiny or mesh with realities on the ground (see here, here, here and here). These studies also claim that, relative to international standards, concentration levels in wireless services in Canada are at the low end of the range, demonstrating, they claim, that the Canadian market is actually quite competitive.

Claims that there is no wireless competition problem in Canada, however, clash with the reality that CR4 scores have been stuck in the ninety-percent range for the entire history of wireless in Canada, a level well-above the Competition Bureau’s standards. CR and HHI scores have drifted downwards recently after new rules to encourage new entrants were adopted for the spectrum auctions of 2008 and 2013, respectively, and the government’s newfound resolve over the past year to curb stubbornly high levels of concentration in the mobile wireless market. Nonetheless, in 2013, the HHI score was 2822 – well above 2,500, the threshold that defines a highly concentrated market.

Moreover, national measures of wireless concentration understate substantially actual conditions on the ground in specific provinces, regions and cities. Indeed, as CRTC data illustrates, at the provincial level, the most competitive market is in Quebec where there are four reasonably strong players: Bell (33.5% share of revenues), Rogers, (29.4%), Telus (28.4%) and Quebecor (6.3%). The top two players – Bell and Rogers – account for 62% of the market (see here and here, p. 216), an exceptional figure unrivalled nowhere else in the country.

In Alberta, Ontario and BC, the figures are in the mid-70 percent range, while the numbers are higher yet in the rest of the provinces: Saskatchewan (81%), New Brunswick (83%), Nova Scotia (86%), PEI (88%) and finally in the Newfoundland, Labrador and the Far North, the top two providers account for 99% of all revenues. In sum, no matter how one looks at it, by city, region, province, or country, or by revenue, subscribers, or spectrum held and used, mobile wireless services in Canada are highly concentrated, with Quebec offering a partial exception, and with significantly lower wireless prices to match such conditions (for a fuller account of these and similar points, see CMCR, Mobile Wireless in Canada).

It is true that prevailing CR and HHI levels in Canada are not especially high by international standards, and in fact are at the lower end of the scale relative to OECD countries. However, the more pressing point, as Eli Noam (2013) observes, is that concentration levels in mobile wireless and other platform media industries are, with few exceptions, “astonishingly high” everywhere, including Canada (p. 8). Seen in this light, the fact that Canada is at the low end of the heavily concentrated scale is not reason to do nothing but rather to consider what the best options are to deal with a “bad” situation.

Internet Access

As the telecoms and Internet boom gathered steam in the late 1990s new players emerged and become significant competitors. Indeed, by 1996, the incumbent telephone and cable companies presence remained minimal and four new companies accounted for over a third of the ISP market by 1996: AOL (12.1%), Istar, (7.2%), Hook-Up (6.3%) and Internet Direct (6.2%). To put this another way, incumbents were slow to arrive and in the meantime, new comers stepped into the breach to develop internet access in Canada.

The early ‘competitive ISP era’ continued up to the turn-of-the-century but increasingly subsided thereafter on account of, first, the collapse of the dot.com bubble, when many of the early ISPs went out of business and/or were absorbed by larger players and, second, the switch-over from dial-up to high speed internet access. By 2000, the big four’s (Bell, Shaw, Rogers & Telus) share of the internet access market had grown to 39%, but this was still the most competitive sector of the network media economy at the time.

The industry has steadily consolidated around the incumbent telephone and cable companies since. By 2004, the top four firms accounted for just over half of all revenues. That number grew to 58% by 2008. By 2013, the CR4 had crawled upwards to 61%. The top five companies – Bell, Rogers, Shaw, Videotron, Telus, in that order – accounted for just over 70% of all revenues, by our measures. According to the CRTC’s figures, the number is higher yet: 75% (p. 171).

HHI scores for internet access doubled between 2000 and 2013, but are still low relative to most other sectors and to this measure’s standards for concentration. However, this reflects the limits of the HHI method in this specific case, since 92% of residential internet subscribers use one or another of the incumbent cable or telecom companies’ for internet access (CRTC Communication Monitoring Report, p. 186).

Climbing down from national measures, if we look at the respective shares of the incumbent telcos and cable companies across the country, we discover that they dominate internet access at the local, provincial and regional level in a manner similar to the mobile wireless market. Taken altogether, the incumbent provincial and regional telcos and cable companies account for just over four-fifths of the market: Bell (22.5%), Rogers (14.3%), Shaw (13.6%), Videotron (10.1%), Telus (9.8%), Cogeco (4.6%), SaskTel (1.7%) and MTS (1.5%) (see CMCR data).

The two biggest indy ISPs – TekSavvy (235,000 subscribers) and ExplorNet (200,000) – account for about 3% of revenues. Other small ISPs are on the wane (Primus). According to the CRTC, there are about 500 or so independent ISPs scattered across the country, and altogether they accounted for 8% of internet access revenues in 2013 (CMR, p. 186) – a level that has stayed basically flat since 2010, and which is nowhere near the high-water mark of competitive internet access era in the late-1990s.

Canada has relied on a framework of limited competition between incumbent telecom and cable companies for wireline, wireless, internet access and video distribution markets. Incumbents still dominate every one of these sectors, while smaller rivals continue to eek out an existence on the margins. Such conditions follow the long-standing historical tendency in Canadian telecoms toward the ‘two network’ system outlined earlier (e.g. telegraph vs telcos in the early 1880s, TCTS vs CNCP in the first three-quarters of the 20th century, telcos vs cablecos ever since, and the telco consortium Stentor vs Rogers/Cantel in the early days of mobile wireless).

It is exactly such conditions, and the institutional legacy in which they are couched, that have spawned an examination of the future of mandated wholesale access to the incumbent telcos and cable companies’ networks. The former argue that the existing regime has barely allowed them to survive, encountering obstructionist tactics all along the way, aided and abetted by a weak regulator wedded to a two paths to the home view of the world, and unable to deal forcefully and consistently with the cable and telephone companies. For their part, the latter argue that their upgrade to new fibre-based facilities amounts to complete rebuild of the system from scratch and, in so doing, erases any concerns about how their dominant positions accumulated in the past might squelch competitive forces in the present.

Cable, Satellite and IPTV

Concentration in cable and satellite distribution rose steadily from low levels in the 1980s (HHI=761) to the upper end of the moderately concentrated zone (by the new HHI guidelines) in 1996 (i.e. HHI=2315), before dipping into the competitive zone at the turn-of-the-21st century, when the HHI reached a contemporary low of 1729. Trends swung upwards thereafter for the next half-decade before once again drifting downwards when the incumbent telcos’ roll-out of their new IPTV services began to cut into the cable companies’ territory.

As noted in the last post, the telcos’ IPTV services have more than tripled their subscriber numbers and quadrupled their revenues in the past three years. As a result, they are making deeper incursions into the incumbent cable and satellite service providers’ turf, accounting for just over 11% of the TV distribution market by revenue in 2013 (based on CMCR Project numbers, or about 10.3% using CRTC data) (see CMR, p. 121) (also see here for partial explanation of the differences). The greatest threat to incumbent cable companies is probably in western Canada, where MTS, SaskTel and Telus have rolled out IPTV services faster than Bell from Ontario to the Atlantic.

Since IPTV services began to be rolled out by MTS and SaskTel in 2004, followed later by Telus and Bell in 2008 and 2009/2010, respectively, the HHI score has fallen 238 points (see Table 1 above) and now falls just into the competitive zone. The CR score has also dropped significantly by 8% since 2004. This is a substantial change.

The cable, satellite and IPTV industry, however, is still largely a duopoly at the local and regional level. The big four still dominate with just under four-fifths of the market share: Shaw (23.6%), Bell (23.4%), Rogers (19.7%), and Quebecor (12.1%). Add the next five biggest players – Cogeco (7%), Telus (5.9%), Eastlink (3.7%), SaskTel (.9) and MTS (.8%) – and all but 3% of industry revenues are accounted for. Again, it is local and regional cablecos and telcos that dominate the sector, replicating the familiar pattern of duopoly in yet another area of the platform media industries.

Within the platform media industries as a whole, some new players have emerged, but it is the expansion of the incumbent telcos and cable companies outside their traditional turf and into one anothers’ industries that is having the greatest effect. There has been a modest rise in competition in all platform media sectors in recent years, except internet access, where trends have been in the opposite direction, but from a lower base. In sum, new technologies have increased the structural complexity of platform media, but have not over-turned the long-standing trajectory of development when it comes to tv distribution: more channels, and a few new players, but with the most substantial swathes in the hands of the well established.

The Media Content Industries

Television

In the late 1980s until 1996, concentration in broadcast TV fell sharply while the specialty and pay TV channels that were emerging at this time displayed similarly high levels of competition. TV became much more diverse as a result.

Such trends abruptly reversed in the late-1990s, however, albeit with something of a lag before the specialty and pay TV market began to follow suit. After the turn-of-the-century concentration levels for TV climbed steadily and substantially. The upswing since 2008 has been especially sharp.

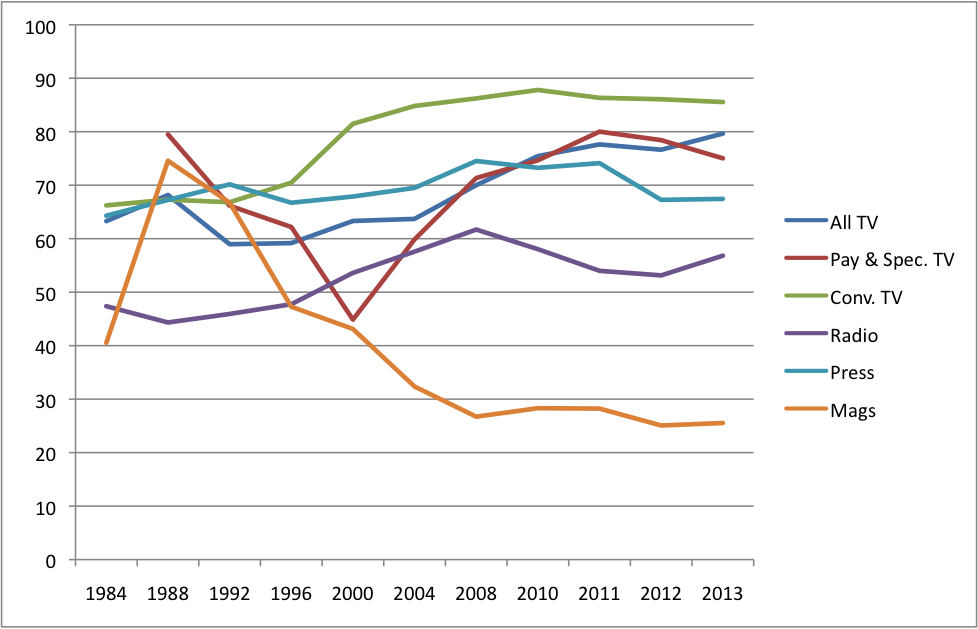

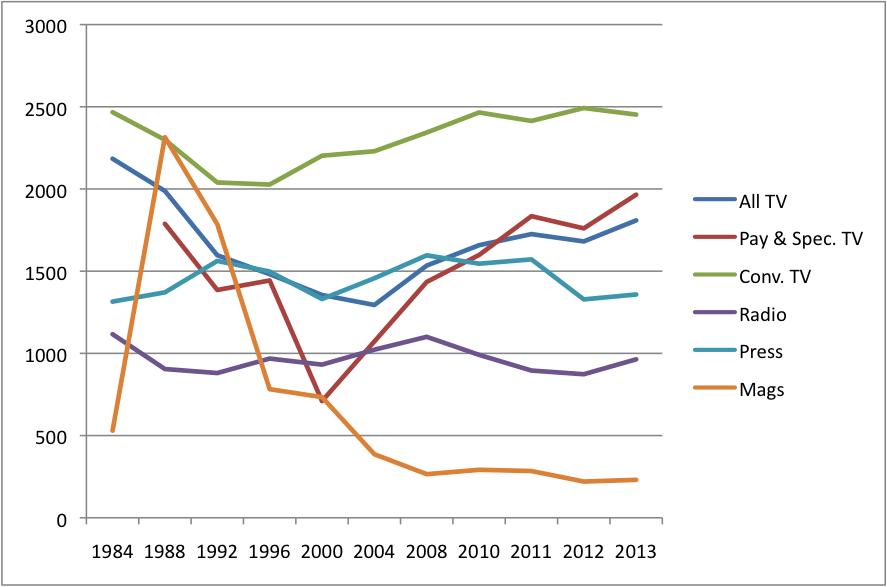

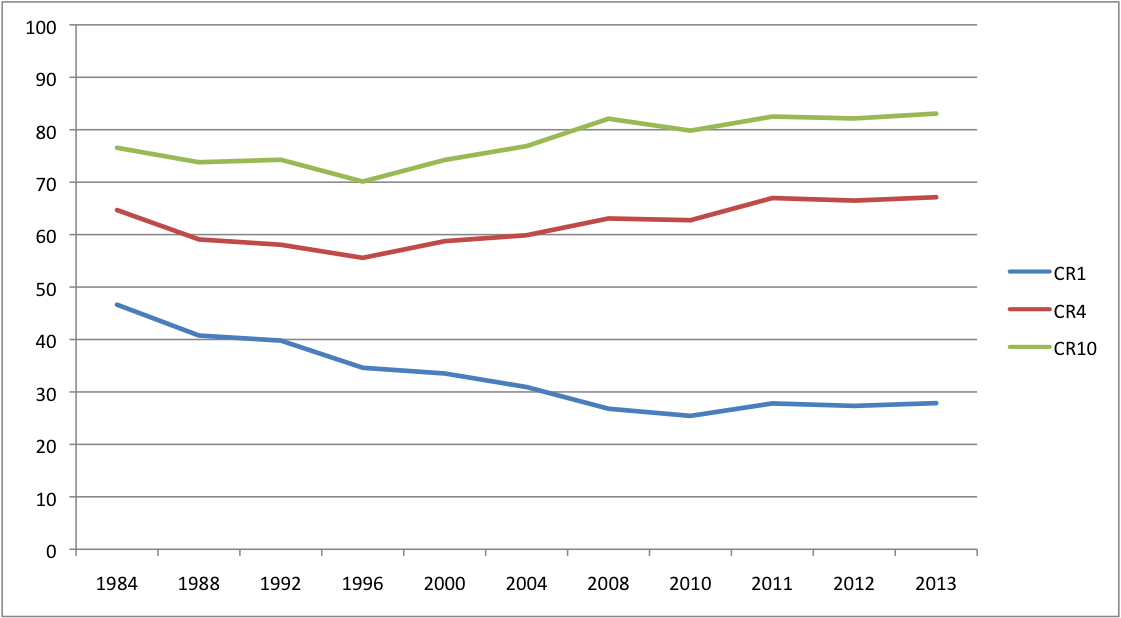

Figure 5, below, shows the trend in terms of CR scores; Figure 6, in terms of the HHI.

Figure 5 CR Scores for the Content Industries, 1984-2013

Sources: Media Industry Data.

Figure 6 HHI Scores for the Content Industries, 1984-2013

Sources: Media Industry Data.

In 2013, the largest four television providers controlled 80% of all television revenues, up from 70% half a decade earlier and further yet on conditions at the turn of the 21st century when the figure was in the low 60% range. Contrast this, as well, with the situation in 2004, when the big four accounted for 64% of the TV biz, and a time when major players such as Alliance Atlantis and CHUM had carved out a significant place for themselves in the TV marketplace (circa 2000-2006), respectively, before being absorbed into the maw of the industry’s largest players.

That concentration across the total TV market has been pushed to new extremes is also born out by changes in the HHI scores. Indeed, the ground shifted significantly from the competitive end of the spectrum in the 2000-2008 period with HHI scores in the 1,300-1,500 range, shooting upwards and into the moderately concentrated zone thereafter. The HHI score in 2013 was 1809, up from 1680 the year before and from an all-time low of just under 1,300 a decade ago.

The recent upsurge in concentration levels in the television market is due mainly to, as mentioned earlier, first, Shaw’s take-over of Canwest’s television assets in 2010. Second, Bell’s buy-back of CTV the year after pushed the levels up greatly, while its take over of Astral in 2013, after a stunning turn-around by the CRTC from the previous year when it curtly dismissed the transaction, fortified the trend – even after Bell divested itself of eleven TV channels, as required by the Competition Bureau and the CRTC: i.e Teletoon (TELETOON Retro, TELETOON Retro, TELETOON / TELETOON, the Cartoon Network), Historia and Séries+ to Corus (Shaw), the Family Channel, Disney Jr. and Disney XD to children’s television programmer, DHX media, and MusiquePlus and MusiMax to V Media.

The Astral and CTV transactions marked Bell’s return to the field after having abandoned its earlier ill-fated convergence fling in the ownership of CTV and The Globe and Mail (circa 2000-2006), a phase in its corporate history that appears to have been expunged from the company’s self-styled history in its recent annual reports (see, for instance, BCE, 2012 Annual Report, p. 20).

These transactions not only marked Bell’s return to the television business, but put it at the top of the league. Its share of the market has risen from roughly a quarter of total TV industry revenues in 2011 to 30% last year, taking into account the divestitures just noted. This is substantially larger the second largest player in the television industry, Shaw (Corus), which had just under 21% of market revenues in 2013.

Together, however, Bell and Shaw dominate over half of the television market in Canada. Add the next three largest television broadcasters and the top five providers possessed 210 of the 700 TV channels licensed to operate in Canada and 90% of total television revenues: Bell (71 conventional, specialty and pay TV channels), Shaw (62), CBC (32), Rogers (26) and Quebecor (19). Overall, the long-run pattern is that concentration levels declined steeply from 1984 to 1992, where they hovered for a decade or so until 2008, before shooting upwards thereafter to levels similar to those that prevailed in the late-1980s.

Similar patterns are replicated in each of thee sub-components of the ‘total television’ measure (conventional television as well as pay and specialty channels) (CMCR Media Industry Data, Television and Television Channels by Ownership Groups). Specialty and pay services are the jewel in the TV crown, but they are also concentrated by the CR4 measure (CR4=75%), yet only moderately so by HHI standards, with a score of 1965.

Newspapers

With some twists and turns along the way, concentration in the newspaper industry rose steadily from 1984 until 2008, when it peaked, albeit from a relatively low level and without ever crossing the threshold from a competitive to a moderately concentrated market. In 1984, the top four groups accounted for 64% of all revenues, a number that has risen slowly but steadily over the intervening years to roughly two-thirds of the market in 1996 and then more sharply upwards in 2008. At that point, the four largest newspaper ownership groups accounted for three-quarters of the market: Canwest (23.9%), Quebecor (21.7%), Torstar (18.1%) and Power Corp / Gesca Media (10.8%) (CMCR Media Industry Data, Newspapers).

Levels have since declined considerably by either the CR4 or HHI measure, with the former falling to 67% in 2013 and the latter dropping from 1596 in 2008 to 1,358 – well within the ‘competitive’ range by the lights of the new HHI standards. The new conditions likely reflect Postmedia’s decision to sell some of its newspapers (Victoria Times Colonist) and to cut publishing schedules at others. Indeed, its market share has fallen steeply from 24% in 2008 when the papers were still in the hands of Canwest to just 17% last year, and within a shrinking market. A few new publishers have also emerged amidst the tough times now facing the newspaper industry, notably Black Publishing and Glacier Publishing in western Canada. This year’s newspaper swaps between Quebecor and Postmedia will be dealt with in next year’s iteration of this post.

Magazines

Of all media sectors, magazines are the least concentrated. Concentration levels fell by nearly half on the basis of CR scores between 1984 and 2013, more than half by the lights of the HHI criteria (CMCR Media Industry Data, Magazines). That said, however, even the best available data for this sector is terrible and needs to be treated with caution.

Radio

Radio is also amongst the most diverse media sectors according to HHI scores, and only slightly concentrated by the C4 measure. The shuffling of several radio stations between Shaw/Corus and Cogeco in 2011 contributed to the long-term decline in concentration.

The downward drift, however, was reversed in 2013 when Bell acquired Astral Media, then Canada’s largest radio broadcaster. The deal catapulted Bell into the being the biggest radio broadcaster in the country, adding 77 radio stations – after divestitures — to the existing ones it already had, for a total of 107 radio stations operating in 55 cities across Canada. Bell’s 21% market share was substantially larger than the CBC’s share (15.2%) and nearly double that of its closest commercial peer, Rogers, which had 11.2%.

Bell’s acquisition of Astral did lead to a significant increase in CR4 and HHI scores, and reversed the downward trend of the previous half decade, but even with this significant uptick, the radio sector was only modestly concentrated by CR4 standards in 2013, with a score of 57%, yet firmly within the competitive zone on the basis of an HHI of 964. Bell’s divestiture of ten radio stations in medium to large size cities across the country at the end of 2013 and into 2014 helped mitigate the effects. The effect of this sell-off may also be to strength the mid-size players in the radio market that acquired them: Newcap (5), Pattison (3) and Corus (Shaw)(2).

Online Media

As the earlier discussion of internet access showed, there is little reason to believe that core elements of the Internet are immune to the processes of consolidation and concentration. But what about the other core elements of the Internet and the digital media ecology: search engines, social media sites, browsers, operating systems and internet news sites?

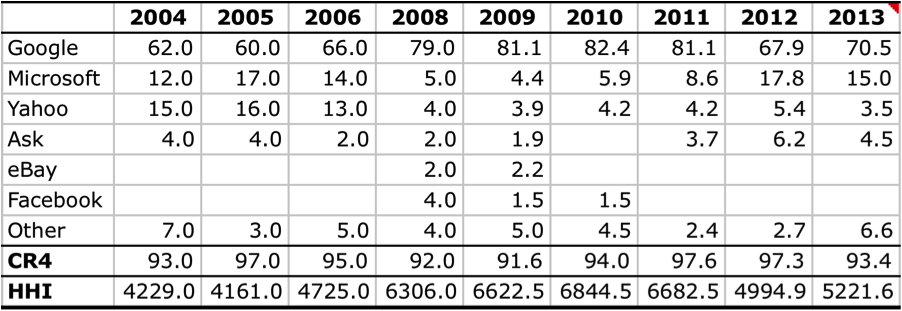

Concentration in the search engine market has been persistently sky-high since 2004. CR scores have been well over 90%, as shown in Table 2 below, and HHI scores have been off-the-charts in the 4000-7000 range. In short, rather than the internet being immune to processes of consolidation, internet search is the most concentrated of all of the different segments of the network media ecology, by far.

Google’s dominance rose sharply from the mid-2000s until the end of the decade, where it hovered in the low 80%-range, before falling in 2010 and 2011. Nonetheless, the search engine giant still dominates search in Canada with roughly 71% market share. Microsoft (15%), Ask.com (4.5%) and Yahoo! (3.5%) trail far behind. CR4 and HHI scores are still sky-high at 93% and 5222, respectively, as Table 2 shows.

Table 2: CR4 and HHI Scores for the Search Engine Market, 2004-2013

Sources: Experien Hitwise Canada. “Main Data Centre: Top 20 Sites & Engines” and “Hitwise Canada Online trends“. Last accessed July 15, 2014.

Social media sites display a similar but not quite as pronounced trend. Facebook accounted for 46% of unique visitors to such sites in March 2013, followed by Twitter (15%), LinkedIn (12%), Tumbler (12%), Instagram (9%) and Pinterest (6%) (Comscore). Again, the CR4 score of 85% and HHI score of 2762 reveal that social networking sites are highly concentrated.

Similar patterns hold for the top four web browsers in Canada. Microsoft’s Explorer (58.2%), Google’s Chrome (18.6%), Firefox (16.3%), Apple’s Safari (5.6%) have a market share of 98.5 percent and a sky-high HHI of 4030 (Netmarketshare). In terms of smart phone operating systems, the top four players had just shy of 100 percent share of the installed OS base: Apple’s iOS (44.2%), Google’s Android OS (46.4%), Java (3%), Nokia’s Symbian (2.6%). Microsoft (2.4%) and RIM (1.2%) accounted for the rest. The HHI score was 4,130 (Netmarketshare).

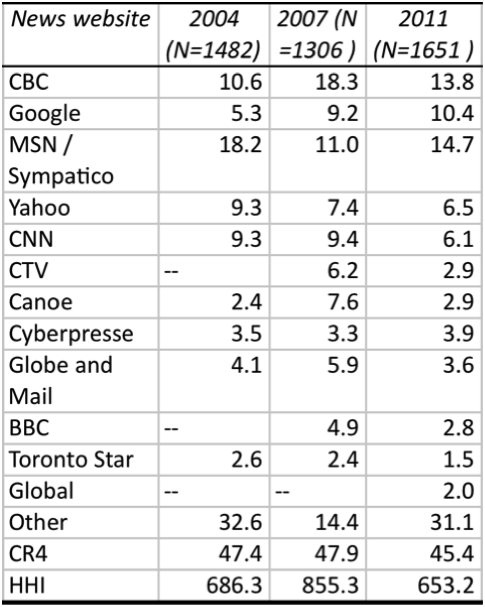

Internet news sites are an exception to the extremely high levels of concentration in the online media environment. The amount of time people spent on the top 10 online news sites nearly doubled from 20 to 38 percent between 2003 and 2008. Moreover, most of that increased time is spent on sites that are extensions of well-known media outlets: CBC / Radio Canada, Quebecor, CTV, the Globe & Mail, Toronto Star, Post Media and Power Corp. Other significant online news sources in Canada include CNN, BBC, Reuters, MSN, Google and Yahoo! (Zamaria & Fletcher, 2008, p. 176).

More recent data show a similar pattern, albeit with some substantial new additions (Huffington Post, Yahoo-ABC, Pelmorex/The Weather Channel) and the disappearance of a few others (BBC, Globe and Mail). Rank ordered, but without sufficient data to get a picture of their relative share of internet traffic, the top ten news and information sites online between March and May, 2014 were: CBC, Quebecor (Canoe), Pelmorex, About, Postmedia, the Huffington Post, Yahoo-ABC, CNN, Torstar and CTV (see here).

Based on the data that is available, a “pooling of attention” on the top 10 or so news sites can be seen, with concentration levels staying flat between 2004 and 2007, before wafting downwards thereafter until 2011 – the latest year for which good data is available. Online news sources are not concentrated by either the CR or HHI measure and are diverse relative to any of the other sectors, except magazines.

Table 3: Internet News Sources, 2004-2011

Source: Table calculated by Fred Fletcher, York University, from the Canadian Internet Project Data sets (Charles Zamaria, Director].

The Network Media Industries as a Whole

The following paragraphs draw this report to a finish by combining all the bits and pieces of the network media economy together into a birds-eye view of long-term trends. Figures 8 and 9, below, start the process by showing the trends across the network media economy over time on the basis of CR1, CR4 and CR10 scores, followed shortly afterwards by a depiction of the trends based on the HHI.

Figure 7: CR, 1, 4 and 10 Scores for the Network Media Economy, 1984-2013

Sources: Media Industry Data (CR4 & HHI Scores).

Looking across the entirety of the network media economy, several distinct points emerge: The biggest company’s share of revenues across the media twenty-eight years ago was 47%; in 2013, it was much less, but still a very large 28%, and within a vastly larger media universe. That company in 1984 was BCE; it still is today, and it is far larger than the second and third-ranked firms, Rogers and Shaw.

The CR4 for the whole of the network media economy in 2013 was roughly the same as it was three decades ago: in the mid-60% range, although up considerably from its low point in the 1990s. At present, Bell (27.9%), Rogers (16.2%), Telus (15.5%) and Shaw (15.5%) make up the ‘big four’.

The most significant and far-reaching change is the ascent of four enormous vertically-integrated telecom, media and internet conglomerates that now account for 56% of total revenues across the network media economy: Bell, Rogers, Shaw and Quebecor. Add Telus to the fold – a company that has not adopted a strategy of vertical-integration — and the market share of the top five Canadian telecom, media and internet companies swells to 71%.

The largest ten firms accounted for just over 83% of all revenues in the network media economy in 2013 — an all time high. This, too, is up significantly from the 1990s when the figure hovered in the mid-70% range, and modestly higher than levels in place in the early 1980s. Once again, the idea of a “u-shaped” curve fits the trends.

All-in-all, after taking account of the top four or five firms, there is a distant second tier of a dozen or so more specialized media, internet and telecoms companies that, combined with the tier one firms, account for just under 90% of the remaining revenues in the network media economy: Google, the CBC, MTS, Cogeco, Sasktel, Torstar, Postmedia, Eastlink, Power Corporation, Facebook, the Globe and Mail and Netflix. Figure 8 below shows their respective rank order based on their Canadian revenues.

Figure 8: Leading Telecom, Media and Internet Companies in Canada, 2013

Sources: Media Industry Data (Vertical Integration & the Network Media Ecology)

A notable change in the past few years is the rise of internet companies up the ranks of the leading media, internet and telecoms companies in Canada. Google’s fast ascent through the ranks, rising from 9th place on the list last year to 6th place this year, stands out in particular. Indeed, it is now second only to the tier one players – Bell, Rogers, Telus, Shaw and QMI – but with a greater share of the media economy the venerable entities such as the CBC, Globe and Mail, Torstar and so on.

Netflix and Facebook also cut significant figures but are modest in their standing within the overall media economy, although not in their respective areas of specialization. Netflix’s estimated revenues in 2013 of $216 million represent about 3% of total TV revenues, an substantial amount that would place it just behind Quebecor’s TVA in the television sector, and ahead of all the main independent television groups combined, i.e. V Interactions, APN, Pelmorex/the Weather Channel, Radio Nord, Blue Ant and Fairchild.

For its part, Facebook’s estimated Canadian revenues of $355 million accounts for about 10% of internet advertising revenues in Canada. While modest within the overall media economy, a better sense of the scale of Facebook’s impact is gained by looking at those areas where it is mostly likely having a significant impact on existing media players, for instance, newspapers who see themselves as battling with digital media giants for advertising revenue. When we do this, the issue becomes clearer indeed, with Facebook’s estimated advertising revenue alone outstripping the online and mobile advertising revenue of the newspaper industry as a whole, i.e. $355 million versus $230.5 million (Newspaper Canada, 2014, p. 6).

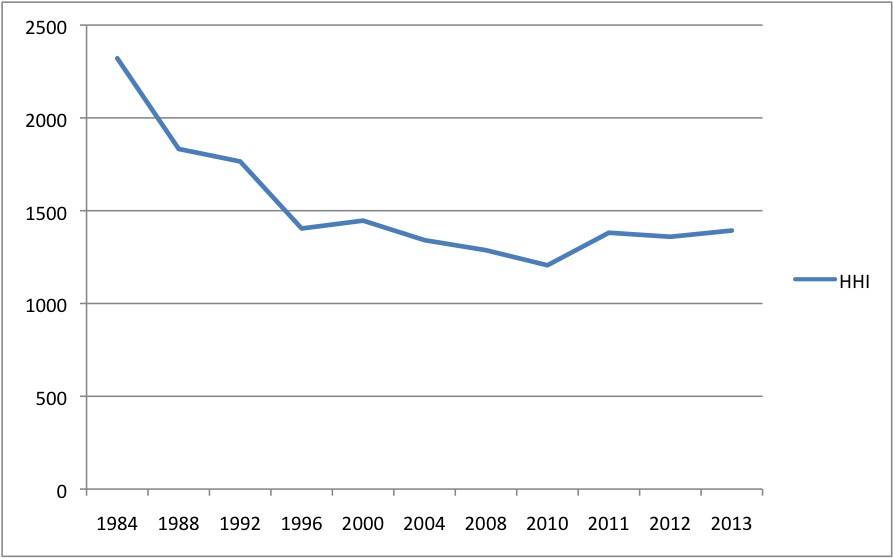

Figure 9 below offers another portrait of concentration trends for the network media industry as a whole, but this time using HHI rather than CR scores, as depicted in Figure 7 above. Similar to the latter, Figure 9 shows a general ‘u-shape’ pattern as well, but with a couple of significant differences.

First, and because the HHI score is a more sensitive instrument with respect to changes in levels of competition and concentration, HHI scores fell steeply from 1984 to 1996, then gently for the next decade and a half, with whatever increases in concentration that were taking place in specific sectors largely being offset by increases in the size of the media economy as a whole. The significant step upwards from 2010 onwards also stands out, although the end results depict a scenario that fits comfortably within the competitive zone based on the revised 2010 HHI standards (or moderately concentrated by the old standards).

Figure 9: HHI Scores for the Network Media Economy, 1984-2013

Sources: Media Industry Data (CR4 & HHI Scores).

So, if we take HHI scores for the ‘total media universe’ as the beginning and endpoint of our analysis, this is our conclusion: the overall media economy in Canada has seen trends fall substantially over time to a comfortable state where concentration levels are lower than what they were at the turn-of-the-21st century and a far from what they were in 1984. This is exactly what observers who argue that continued concern with media and internet concentration is both wrong and wrong-headed, such as Ben Compaine, Ken Goldstein and Brent Skorup and Adam Theirer, tend to do.

That conclusion, however, is problematic for several reasons. First, and as just noted, because it takes the ‘birds-eye’ view as the beginning and end of the story it obscures specific trends at lower levels of analysis, i.e. the sector-by-sector and then category level – platform media, content media and online media – analysis before moving up to the total network media. We use the “scaffolding method” precisely so that we can pick up on such things, whereas starting at the high-end view, and sticking within it the whole way through, dulls the sensitivity of the HHI method in relation to sector-specific changes.

In contrast, our method reveals a more variegated portrait emerges that is sensitive to changes in specific sectors, categories and the network media as a whole, as well as over time. Figure 10 below gives a snapshot of the network media in 2013, listing sectors that were unconcentrated, those that were moderately concentrated, and finally those that were highly concentrated by HHI standards.

Figure 10: Concentration Rankings on the basis of HHI Scores, 2013

Finally, the magnitude of the uptick in concentration levels across the network media economy from 2008 onward that is shown in Figure 9 above suggests that drawing any conclusions at the point in time would be to prematurely foreclose the end of the story.

Clearly, things are not all to one side, with several sectors showing low levels of concentration, at least on a national basis: magazines, radio, newspapers, cable, satellite and IPTV, and internet access. However, all segments of the television market – conventional, pay and specialty and ‘total TV’ – had moderately high levels of concentration. Perhaps one of the most striking things to stand out from this analysis is the extent to which core elements of the mobile and internet-centric digital media ecology seem to be prone to very high levels of concentration.

Concluding Thoughts

Several things stand out from this exercise. First, we are far from a time when studies of media and internet concentration are passé. Indeed, theoretically-informed and empirically-driven research is badly needed because there is a dearth of quality data available.

Moreover, general developments and the press of specific events — the Bell Astral deal, the wireless wars of the past year, and the slew of ongoing regulatory reviews of wholesale telecoms markets, Mobile TV services and attempts by the vertically-integrated telecom and media giants (Rogers, Bell, Quebecor) to leverage exclusive and/or steeply discounted access to television programming in general and to premium content specifically to drive subscriptions to their wireless, cable and internet services – are all indicators that the politics of communication is on a very high boil. How the politics of the moment, and the decisions made as a result, play out will play a constitutive role with respect to how the ever more internet-centric media ecology will be institutionalized for years, and probably decades, to come.

Within such a context, it is crucial to straddle the irreconciliable tensions between meeting the need to have a good body of long-term and systematic evidence ready-to-hand in the hope that decisions will be based on informed grounds, while not pretending that one can stand aloof from such matters, as if dispassionate analysis is either wholly desirable and even possible. That said, however, straddling these competing pulls must not succumb to the politicization of research to the extent that it merely serves as a vehicle for one’s own ideological views and hoped for political outcomes. The world is a far more uncertain place than what such a stance would have to presuppose. Thus, while it is probably a good thing to be committed and passionate about these issues, as I am, good scholarship has to be honest and up front with its views, which I hope readers of this and other CMCR research will see.

The kind of data required for the task at hand remains incredibly hard to come by and data collection for 2013 reconfirmed this at every step of the way. The CRTC’s recent overhaul of its website goes some way to meeting this need, but more is required. Among other things, the underlying data sets included in the Communications Monitoring Report, Aggregate Annual Returns, and Financial Summaries should be made available in a downloadable, open format, for instance (also see David Ellis’ series of posts on this point).

The regulated companies themselves must also be made to be more forthcoming with data relevant to the issues, not less, as they so strongly desire. The mountain of documents they have submitted to the raft of proceedings now underway, as discussed above, are chock-a-block full of hashtags (###) that blot out the essential information upon which public understanding, and direct citizen input into the regulatory cases in front of the CRTC, depends. Furthermore, the CRTC also publishes too much data that does not square with what the companies themselves state in their Annual Reports. Good decisions cannot be made on poor data.

The trajectory of events in Canada is similar to patterns in the United States. Concentration levels declined in the 1980s, rose sharply in the late-1990s until peaking circa 2000 and staying mostly flat thereafter. While processes of deconsolidation and vertical dis-integration have taken hold internationally and in the US — with the exception of Comcast’s 2011 blockbuster take-over of NBC-Universal — trends in Canada are running full steam in the opposite direction, having accelerated greatly since 2010. As a result, while concentration levels in Canada are not especially high by international standards, in terms of vertical integration and cross-media ownership, they are extraordinarily high, in fact, the highest amongst the 28 countries studied by the International Media Concentration Research project for which adequate data is available.

Arguably, this is the most important consideration rather than concerns with media concentration in general. This is because the vertically-integrated giants that now straddle the mediascape are engaged in a grand yet endless game of whack-a-mole, leveraging their great power over carriage and content to restrict competitors and influence people’s choices, behaviour and their right to communicate and enjoy a media environment that comports with their needs and desires to the greatest extent possible.

This has put the potential remedy of structural and functional separation back on the table in Canada at present in ways not seen in recent times. Such measures are not antithetical to communication policy traditions in this country, and in fact are synonymous with it by way of the tradition of common carriage and the ‘two networks model’ that have co-evolved with the history of telecommunications in Canada (and North America) since the late-19th century, until being thrown over-board, foolishly, on the eve of the 21st century.

The Competition Bureau has raised such prospects, as have some academics, and other countries such as the UK, New Zealand, Australia and across Europe have put them in place. Proposals for structural or functional separation that may have been unthinkable a few years ago but which now seem to fit the bill reflect changes in the ‘real world’. When vertical integration is as high as it is in Canada, it is essential that strong countervailing forces be put firmly into place (see, for example, Competition Bureau, 2014; Middleton, 2011; Benkler, et. al., 2010).

The current sweeping slate of reviews in official venues around access to the fundamental resources of the media economy – professionally produced, premium content, networks, bandwidth, buildings, spectrum, towers and other essential resources – are indicative of the problems stemming for high levels of concentration in the platform media industries in particular, especially when looked at from the local, regional and provincial level, rather than the country as a whole, and more importantly, with a clear eye on the rise and place of vertical integration within the Canadian mediascape in the past half-decade.

But there is more to this than just formalistic policy proposals based on arcane principles and scholarly or policy analysis. There is also a politics to these issues that reaches deep into the lives of ordinary Canadians but also into the boardrooms and banks of the nation.

Intuitively, Canadians seem to have a pretty good sense of the lay-of-the-land, and are unhappy about it, enough so to drive the Harper Government to respond with measures that, at first blush, appeal to popular discontent. However, it is much more than this, and journalistic and incumbent pooh-poohing of the government’s policies on this front, whether in relation to ‘pick-and-pay’ for cable TV or wireless roaming caps and the promotion of a fourth national wireless carriers, miss the fact that taking on the telecom giants while pandering to digital media giants such as Netflix and Google plays well to key constituents of the geek internet, business and venture capital crowds as well.

The critique of concentration, as it as always done, plays to the business and investment crowd, not just some idyllic leftist notions of agrarian and labour populism, although there is no need to treat such interests and concerns lightly at all (see for instance John, 2012, Robber Barons Redux). This is no less the case now than it was in the late-19th and early-20th centuries. Those who demand high end communication capabilities see concentration in telecoms markets and the growing grip of sprawling telecom, media and internet conglomerates across the network media economy as strangling the life-blood of their own businesses when they must compete with businesses from Europe, China, India and other countries around the world, where access to high quality and affordable communications are on offer at far more affordable rates than Canadian businesses have access to (see OECD, 2013, p. 21)

For the investment crowd, things cut in cross-cutting directions, as they tend to do. The big five Canadian banks all hold significant and overlapping stakes in the major telecoms, media and internet conglomerates, and are seemingly happy to have “rational management” by a handful of firms rather than cut-throw, price-based competition rule the day. This has been the case since the J.P. Morgans of the world underwrote the worldwide expansion of submarine telegraph cables and continental telegraph systems in the 19th century while insisting that these industries avoid what they called “ruinous competition” (Winseck & Pike, 2007). And while the analogy should not be drawn too tightly, then, as now, competition can occur on lots of things but price is generally not one of them in media and communication markets that are oligopolistic rather than competitive in nature (see Dobby, for an interesting recent account of this phenomenon).

However, those who find investment opportunities choked off by tight oligopolies and “rational management” of the telecoms industry chafe at such arrangements, and so it is today that we see entrepreneurs and investors alike lining up in front of regulators and ministers pleading their case for a more open and competitive telecoms and media economy. It is this mixture of populist politics, appeals to the ‘internet crowd’, and an elite appeal to business people and investors that makes the politics of telecoms and media such a potent force at present, and why events continue to unfold at a frenetic pace, and why the incumbents, despite their powerful perches atop a massive set of industries, likely find little room for complacency and comfort, undoubtedly, at times, feeling under siege.

Of course, trends are not all to one side. The assets from the bankrupt Canwest have been shuffled in recent years, and the process is ongoing with Postmedia selling off more papers in the past year, thereby allowing small and mid-size newspaper publishers to grow (Black Publishing, Glacier), while recent intra-industry shuffles between, notably, Quebecor, Postmedia and Transcontinental, continue apace.

Some significant new voices have emerged (Blue Ant, Post Media, V Interactions, Teksavvy, V Media, Netflix, the Tyee, Rabble.ca, Huffington Post, a worker-owned TV station in Victoria, CHEK, and a and CHCH in Victoria and another independently owned TV station in Hamilton, CHCH). The overall effect is that we have a set of bigger and structurally more complicated and diverse media industries, but these industries have generally become more concentrated, not less.